Welcome – Getting to Malta

Are you thinking about emigrating to Malta?

I’m happy to hear that. In any case, you have come to the right place with your project…

…I have summarized the most important information about living in Malta for you.

Let’s not waste any more time. Here we go.

I am glad that you found your way to my blog, and that you are also interested in emigrating to Malta.

When I arrived here in 2011, I was a bit skeptical at first. However, my concerns were put to rest within a very short time.

Believe me: living where others go on vacation – that’s not just a cliché. Sunshine and warm temperatures, the sea on your doorstep, and so much more. Malta’s worth it.

The fact that you are giving it some thought in advance is more than commendable. Emigration has an impact on almost every area of life, and a step like this needs to be carefully considered.

In the course of my work at the law firm, Dr. Werner & Partner, I often meet prospective clients who have not yet dealt with the country at all, and for whom only the local tax advantages are decisive.

I’m sure you’ve also heard about Malta’s tax advantages. The fact that they play a major role when it comes to the question of whether or not to emigrate to Malta is also absolutely legitimate. For me, however, it is always important to say:

The tax benefits should not be the only reason why you want to emigrate.

If you don’t like warm temperatures, or if the Maltese philosophy of life is foreign to you, you will not be happy in Malta.

That’s why I haven’t focused exclusively on tax-related aspects in this list; I have also provided details about the country itself. This way, you can get an overall picture of the island state of Malta.

I’m happy to be able to povide you with my information in this way. If you have any questions, please feel free to write to me using the contact form at the bottom of the page.

And should you need any further advice, we would be happy to meet with you over a coffee at the offices of Dr. Werner & Partner.

Greetings from sunny Malta,

Philipp M. Sauerborn

The Maltese ID Card – a must in Malta!

Not in this case: the Maltese ID card opens many doors.

Now I’ll explain why you should get this little card. Or have to anyway. Because if you stay in Malta for 3 months per year, that is 90 days, you have to apply for an ID card.

First of all, a technical question: What is the Malta ID card?

You can compare it with the German identity card. The German Perso has a lot more clout, legally speaking.

The Malta ID is a “national ID card” and is a fully identification-enabling and travel-enabling official state document of the Republic of Malta.

However

If you have the ID card in your hands, do not go to the airport with it. Because no airline I know accepts the Malta ID as a travel document. That’s purely a policy thing and that’s what I mean when I say he German Perso has more oomph.

But for identification, whether in Malta or outside Malta, I have never had any problems with it.

How to obtain the Malta ID card- legal requirements.

In order to apply for the Malta ID, you must meet one of the following requirements. You have to

- Be employed (employed)

- Jobseeker, registered as such with the Maltese employment office JobsPlus (unemployed).

- Welfare recipients in Malta

- Privatier (Financially self sufficient)

For this article, however, I will only describe prerequisites 1 and 4.

Malta ID Card as an employee

This is by far the most common form of Malta ID application I have accompanied. This is because every client I work for usually sets up a Malta Limited and then employs himself with that company. This is perfectly legal and a good, accepted practice.

The employment has the unique advantage that you can easily and quickly get the documents you need for the Malta ID Card application:

The signed employment contract and the registration of employment together with the ID Card application itself.

Important: from a person who can provide this evidence and also have a Maltese ID card, do not have to provide the evidence themselves.

Malta ID as private

A current bank statement showing 14,000 EUR cash in the account. If you are married, this amount must be at least EUR 23,000.

Per family member also EUR 2,400.

You must therefore prove that you have private health insurance that covers you in Malta, not as a tourist, but as a resident of Malta.

This is why the Malta ID Card is mandatory

Well, for the first as already mentioned above, there is the legal obligation.

Secondly, Malta ID Card number becomes your central super number in Malta. It is used as a tax number, for a driver’s license, and is requested for doctor or hospital appointments. Furthermore, no bank appointment is conceivable without the ID card.

Above all, it is a very effective document so that you can prove that you live in Malta.

Also it helps to much cheaper bus tickets to borrowing in a library. While applying for the card often tries your patience (I could tell stories!) given the benefits, it’s a must for any Malta expat.

Equally important: your landlord must confirm that you are a tenant of his apartment. There is also a form for this purpose. If you own an apartment or a house, you must register your property accordingly.

Background:

In the past, dozens of people were often registered as residing in one household just to pretend to be resident in Malta. To put a stop to this, and to keep track of how many people are really living in a given household, there is now a landlord’s certificate, similar to the one in Germany.

Where can I get the ID Card?

You can get the ID Card at the Identity Malta Head Office in Msida (Identity Malta Agency Head Office, Valley Road, Msida, MSD 9020). The procedure has changed a bit since covid: currently, the necessary documents must be sent to eu.ima@gov.mt (for EU citizens) by email. A list with all necessary documents can be found https://www.identitymalta.com/unit/e-id-cards-unit/#Applying-for-an-e-ID-Card

The photo is taken at the Head Office of the Authority.

Again about two to three weeks later you will receive mail with a pick-up slip. You can then – who would have thought it – pick up your new ID card with the pick-up slip.

The whole procedure may well take two months. Until then, you can simply use your existing ID card.

Tip: Identity Malta’s building is relatively new and large, and the agency’s logo is large on the side. As an EU citizen, you must use the side entrance on the left side of the building to apply for your ID card.

When using filler words, please make sure that they are used correctly. Things like “namely” must always be followed by a colon, questions must always be followed by a question mark, etc. Please check again for all articles and all filler words/filler sentences.

Online services with a Maltese eID

One thing that I see as a great advantage in the public system of Malta is that digitisation is well advanced here. A great many bureaucratic processes take place completely digitally, and are centrally regulated via a login linked to your ID card.

Be it your personal taxes, VAT returns for your business, or even all your medical records, they are handled online, with a single login.

Note on our own behalf: as part of the relocation package offered by the law firm, Dr. Werner & Partner, our staff will take care of the application for the ID card and the communication with the authorities for you.

FAQ Malta ID Card

You can compare the ID card in Malta with the German identity card or with the Italian Carta Dindentita. However, the Maltese ID card is issued to anyone who resides in Malta, so not only citizens.

Without citizenship, you get the card as an EU citizen if you live in Malta and

-

- Self-employed is registered

- Jobseeker is

- Employed is

From the request about 6 week

It makes the application and success rate much easier if you seek professional help with this, because the process and application is complex.

Yep. Airlines do not accept the Maltese ÍD Card, but in principle it is valid for travel and identification.

Live a carefree life in Malta – with proper planning.

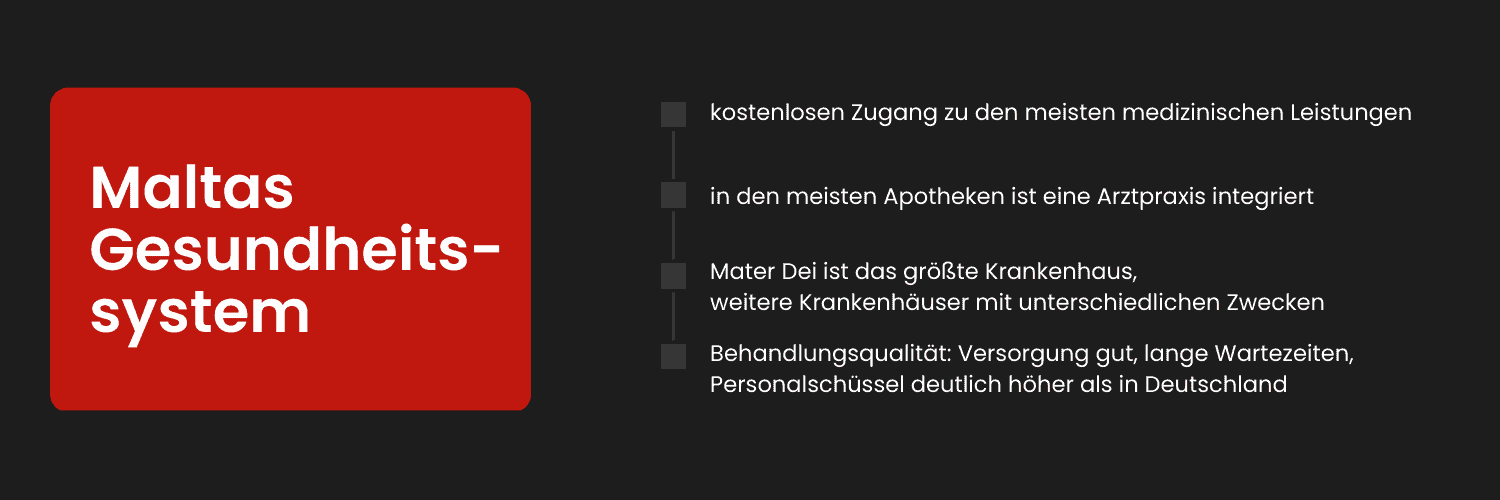

The Maltese healthcare system – how good is it?

When it comes to the Maltese health care system, for many years, we heard nothing good about it from many quarters. And I don’t want to absolve my blog of that in any way.

But the good news is:

a lot has changed in that regard.

But before I discuss the conditions, I would like to explain the basic system. It’s different from the German system.

Whenever I report on other countries, a chapter or even an entire article is always about the health care system in one of these “other” countries.

Of course, before emigrating to Malta, you want to know what the medical situation is there.

And I can report to you that Malta compares comparatively well to many other countries I have lived in, or visited, or even reported on.

But compared to Germany or Austria in particular, Malta is clearly worse. But let me narrow that down directly and put it in perspective, because the system work entirely differently.

In direct comparison with Germany or Austria, comfort in Malta tends to be less dominant in the public system, but this is because the systems operate entirely differently.

Public health insurance Malta? Missing

The system in Malta is a government-run health care system called Malta Health. Similar to the Malta ID card, there are requirements on how to participate:

You must have a job in Malta with a monthly pay slip.

Or

You must be registered in Malta as a job seeker or social welfare recipient.

That’s a big difference, for example, with the UK NHS, which is the state-run healthcare system in the UK. There you just go to the hospital or doctor if you live in the UK, free of charge.

In Malta, you will be regularly asked mach the pay slips of the last 3 months when it comes to the free use of the government health service.

There are no statutory health insurance companies in Malta. But neither are their relatively high monthly taxes, which in Germany are deducted directly from your wages.

You pay only SSC in Malta.

Malta Social Security – the payer of medical care. And these contributions are considerably, not to say spectacularly, cheaper than those of the public health insurance companies outside Malta.

This means that there is more net from the gross. However, public care, free care, similar to the UK, is much more tightly organized and much more centralized in Malta.

If you want to use the state system free of charge, you must comply with this organization.

But honestly:

If you do as I do, you may not even notice the difference. Because what I recommend is a split. A distinction between minor and major “aches and pains.”

For the small ones, you go as a self-payer to the private providers like private doctors or the private hospitals.

For the big aches and pains, you can also get private treatment. There are even private health insurance companies in Malta. But: medically, there is not really a choice for true medical emergencies. Because in case of a real, serious complication in the best private hospital in Malta, you would be taken to the main central hospital in Malta by return of post anyway.

To Mater Dei Hospital

Therefore, the choice may fall directly on the state, for example, if you are planning surgery. Or a birth.

And it is precisely through the example of birth that I can best explain it.

When my daughter was born we thought about a private delivery. The cost was 2500 EUR approximately compared to the state system. A manageable price.

But then the following announcement:

“If something goes wrong, the mother and child are taken to Mater Dei Hospital.”

Well. That is, I go private only to end up possibly worse off because there is an ambulance transport of about 1h when the air is on fire?

We opted for public care, which means delivery at Mater Die Hospital.

And the experience and result was top, kudos.

However, and now I come back to the big and small aches and pains. If you need a prescription or with a sprained foot and want to use government care for that, namely one of the Health Centers or the Mater Dei Hospital Emergency Room:

Be prepared for long waiting times.

But if your time is precious or even paid, then I recommend the many private options for the little auas. There you will be taken care of quickly and well for a fee of 5-30 EUR.

Private opportunities include:

St James Private Hospital in Sliema

One of the many established private practices e.g. gynecological the Verdana Clinic in Msida or

Trick 17: Doctor’s office in the back room of Malta’s pharmacies.

Perhaps you have been to a pharmacy in Malta and wondered why there are chairs and people waiting for them. These people are not waiting for the pharmacist, but for a doctor.

This is because most private medical practices are located in pharmacies and operated by pharmacies. And there you will find regular or specialized doctors. Typically, physicians revolve and rotate from pharmacy to pharmacy per weekday and per week.

With or without appointment:

It makes sense, especially if you need the advice or help of a specialist, that you make an appointment with the pharmacy. But if there is something urgent.

It also works without.

That means you can turn up without an appointment, sign up for an exam, and after a short wait, it’s your turn. They don’t keep your medical records there. That’s all done through a central system (eHealth).

Cost: between 5 and 15 euros, to be paid at the pharmacy after treatment. Information about opening hours and doctors on duty are available on the website Pharmacy.com.mt.

A tip for you at this point: the pharmacy and the doctor are, of course, mutually beneficial to each other.

That means: the doctor will probably prescribe something every time, even if it’s just vitamins. It is up to you to decide whether you’re going to buy them or not. But it pays to question whether or not you really need the preparation.

Emergency Care: the Mater Dei is the largest hospital in Malta

The largest hospital in Malta is the Mater Dei.

And believe me: it’s big, even by German standards.

Besides the Mater Dei, there are several other hospitals with various purposes, distributed all over the island. They are:

- Mater Dei Hospital (L-Isptar Mater Dei), Msida, Emergency and Teaching Hospital

- Sir Anthony Mamo Oncology Hospital (L-Isptar Sir Anthony Mamo), Msida, Oncological Clinic.

- Karin Grech Hospital (L-Isptar Karen Grech), Pietà, Rehabilitation Clinic.

- Sir Paul Boffa Hospital (L-Isptar Boffa) , Floriana, Specialised Oncological, Palliative Medicine and Dermatological Hospital.

- St. Vincent De Paul Residence (San Vincenz de Paul or L-Ingieret), Luqa, Long-term Care.

- Mount Carmel Hospital (L-Isptar Monti Karmeli), Attard, Psychiatric Clinic.

- Gozo General Hospital (L-Isptar Generali ta’ Ghawdex), Victoria Gozo, General Hospital.

People living in the region around St. Julians and Sliema, in particular, are usually treated at Mater Dei, as necessary.

Now to the quality of the treatment:

The waiting times are definitely not pleasant. Those who are not classified as an emergency often have to wait hours before they are treated.

It’s not really different elsewhere, I know, yet you should be aware that if you’re going to be treated at Mater Dei, you’d better take the day off.

In my opinion, the quality of treatment as such has improved significantly. Of course, I am not a medical doctor, so my assessment here is purely subjective. I haven’t needed long-term treatment myself, but unfortunately, my brother, who also lives in Malta, had to spend a few days in the hospital.

In his experience, the care is really good. For example, the staffing ratio is significantly higher than it is in Germany, and the employees take a lot of time for their patients.

Also, the equipment, etc. available is in no way outdated. So there’s really nothing to worry about in that respect. Unless you’re a gourmet. Then you definitely won’t be impressed with the hospital food.

FAQ Malta Health System

Malta operates a state-run system called “Malta Health Care.” State means that there is no health insurance, but that everyone who lives and works in Malta or is subject to social security is covered free of charge.

Yes. In fact, all “private practice” medical offices are for private use only. There are also private health insurance companies and private hospitals.

No. It is common to pay one of the private practices or one of the private hospitals directly for “minor” ailments, including, for example, the dentist. But also in almost every pharmacy in Malta you can find a private practice with changing doctors. A standard examination costs between 10 and 30 EUR.

Medically yes but the comfort for an inpatient stay is a little worse than e.g. in Germany.

Yes, in the state system, that is, when using the Mater Dei Central Hospital or one of the WalkIn Health Centers as an outpatient, one must expect waiting times.

The waiting time in private practices or in private hospitals such as St James Hospital in Sliema is significantly lower.

Live a carefree life in Malta – with proper planning.

Emigrating to Malta – what tax authorities say

Your plan to emigrate to Malta has at least one opponent: your local tax office.

The reason: if you leave, the tax office loses out on your taxes….

…and as everyone knows, when it comes to this matter, the tax authorities don’t have a sense of humour.

Please note: Only those who hold shares in a corporation must pay closer attention to the tax implications when moving away. If you are “only” a tradesman, i.e. self-employed, at least the issue of exit tax does not apply. (more below)

So that you know what to expect: this is what’s in store for you.

Moving to Malta can often result in significant tax relief.

You already knew that. But what are the consequences?

Well, you move your place of residence, and are therefore initially liable for taxation in Malta. As a result, the German or Swiss tax authorities, or those of whatever country you were previously domiciled in, come away empty-handed.

And one thing’s for sure:

Your local tax office isn’t going to like it one little bit!

Actually, it goes even further. Because actually it is not the tax office, but even the legislator. And you can even think one step more drastically:

Actually, it is a group or a bloc of legislators, of countries that do not like a move of your citizens to Malta.

And I’m often asked why that is, because at least in the EU you should be able to move around freely. You can too. In the context of Emi / Imigration. But not fiscal.

Well, you can already tax law, but it can be expensive.

And the logic (which is constitutionally thus EU legally compliant) is the following:

As an example: You live in Germany for your whole life and have built up something in the last 10 years. You have established a limited liability company that is making more profits year after year. And now you want to leave.

Your domestic tax office assumes that your profits and the value of your GmbH are only so high because you have built it up in Germany.

The German infrastructure could use, German employees, German periphery. Maybe even the good German name and image.

So if you move away then you have to dig into your pocket once again.

Whatever the legal logic and history of such an “exit tax” or exit tax:

Basically, it’s all about making you uncomfortable. Or even better: to make it unpleasant for Malta.

It’s about money and all tricks are allowed. By the way: https://de.wikipedia.org/wiki/Reichsfluchtsteuer

Be that as it may:

Withdrawal taxation, to which I devote an entire chapter below, is really your number one enemy.

In 2023, due to the digital traces that are left behind, but also due to the digital possibilities, it is no longer necessary to point out that you cannot fake your residence in Malta.

That you should move completely or not at all. That you have to move with bag and baggage and give up everything in Germany.

Because at this point I also have to say that it often goes against the grain of the authorities, and rightly so. Too often in the past, people pretended to live in Malta (to benefit from the tax advantages) without really settling in Malta. Then the situation is clear. The tax burden is shifted on the basis of false information – and that is a crime called tax evasion. Recently, this offense also falls into the category of money laundering, which can have really serious consequences (but more on this in a forthcoming video).

While this practice may have often gone undetected previously, it is practically unthinkable today. At every point you pass in the course of tax optimization in Malta, you will encounter transparency. International financial agreements, such as BEPS or FACTA, have greatly reduced undetected tax fraud.

My opinion on the matter: super!

In fact, I believe that the transparency you gain can be your greatest friend. Because, as mentioned at the beginning, your local tax office will not be happy that you suddenly have to pay your taxes in Malta. Quite often, you will be required to prove that Malta is the rightful country where your tax burden is incurred.

And if you really generated the taxable income in Malta, I can assure you that you will have no problems.

Residents of Malta can easily prove genuine value creation in Malta.

So, if you settle there, forget about hide-and-seek tactics and always be honest – an approach that has proven itself, and that we consistently apply at the law firm of Dr. Werner & Partner.

Interesting info for globetrotters and digital nomads: you’ve probably heard of the 183-day rule. This number is always used when determining the centre of life.

The general assumption here is: anyone who spends more than 183 days in a country also has their centre of life there.

What about people who do not spend more than 183 days in any country, as is the case with digital nomads, for example?

Then other factors are applied, which also work for the assessment of where the centre of life actually is. Surely you agree that if someone jumps from country to country all year round, and only lives with the family for three months in the summer, it is fair to assume that the family home is their centre of life. Simply because all other places are more outlandish.

I have already indicated that the same applies to Malta: the important thing is that your centre of life is in Malta. This must be credibly substantiated. It should be obvious that this will be difficult to do if you are only in Malta for two weeks a year. But…

…also considerably less days than 183 are sufficient, provided that Malta is the home port to which you return in between.

Finally, I would like to say that any questions and assumptions that a tax office may have are not a problem for the one who really lives in Malta – the exit tax aside.

I have never counted days or booked extra flights or paid attention to where I stay and for how long.

If you would like to learn more about this, you are welcome to check out my article on the consequences of your choice of residence as a shareholder of a Malta Limited company. There, I have explained in detail what consequences your choice of a place of residence brings with it.

FAQ Tax Office Malta

The tax office in Malta is called “Inland Revenue”.

No. The MFSA or Malta Financial Services Authority is the financial supervisory authority of Malta and has nothing to do with the Malta Revenue Authority.

As a rule, no. The number of the Malta ID card is also the tax number and one is also registered for tax with the issuance of the Maltese ID card.

Yep. If you live in Malta and are employed, and have no other income, then the filing of the Annual Tax Return (FS7) will usually be sufficient for you not to have to file another tax return. Self-employed persons or persons with non-taxed income must submit a “Self Assessment” annually. If Inland Revenue Malta sends you such a Self Assessment, even then you must submit it.

Between 5% and 35% for individuals’

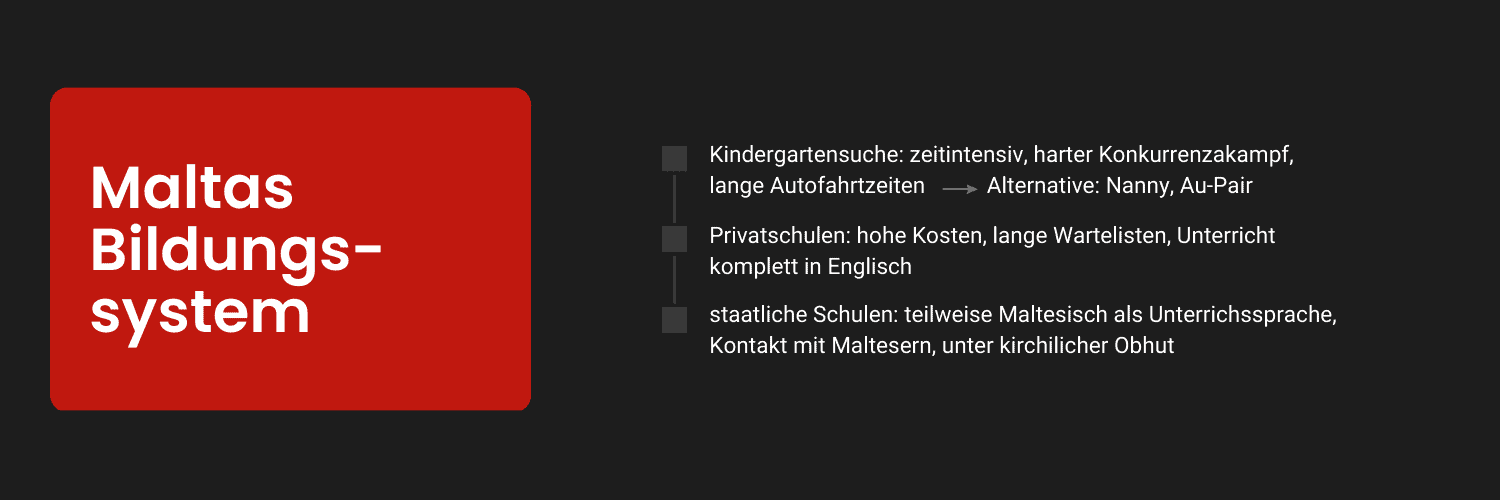

Compulsory Education in Malta – this also applies to the children of immigrants

Would you like to emigrate to Malta with your children?

That’s also possible.

Now I’ll explain

what you need to know about compulsory education, and which schools are recommended.

When I emigrated to Malta with my then fiancée, we did not have any children together.

It’s different today:

Today, I am the proud father of two daughters aged 6 and 8, and thus the topic of kindergarten and compulsory schooling has also gained relevance for me.

I can assure you of one thing in advance: children also have a great life in Malta.

There are several kindergartens, or nursery schools, if you prefer the term, in Malta. However, it pays to take your time when looking for a kindergarten. There are great kindergartens that provide very good care without television. However, you may have to accept longer travelling times to get there.

If both parents want to work, you should also consider a nanny or an au pair. Of course, they are more expensive, but this could be the better alternative for some people.

The subject of compulsory school education.

I have often heard the rumour that school education isn’t compulsory in Malta.

Of course, this is nonsense.

Since 1946, every child has been compelled to attend school until the age of 16.

Here is a brief overview of this compulsory education:

- The elementary school (Primary School): The elementary school at the age of 5 to 11 years.

- Secondary School: The secondary school from11 to 16 years.

- Sixth Form: The Sixth Form in Malta of the last two school years (Year 12 and 13) for students aged 16 to 18.

For you as an expat, the next step is to decide which school to send your children to. You can choose between private international schools and Maltese state schools.

International schools in Malta cost money.

Unlike the Maltese schools, the medium of education is English only at the international schools. Another factor to consider is that at the inernational schools, the children often meet other children whose parents have also emigrated, or who often have to change their place of residence for professional reasons – making new friends is something many of them are familiar with there, so it’s possibly the better option for a more gentle immersion.

The disadvantage of private schools is that they are quite expensive.

The most prestigious private school by far is the Verdala International School. But it comes with a pretty high price tag. On the one hand, the school fees per child amount to several thousand Euros per year, and on the other hand, you also have to be aware that there is a long waiting list if you want to send your child to this school.

The QSI International School is a good alternative. The school advertises the fact that there are no waiting lists. So if you want to accommodate your child at short notice, that’s where you should enquire. Unfortunately, I was unable to find any information about the cost, and I don’t have any direct contacts whose children attend the school. However, asking certainly wouldn’t hurt.

Government schools in Malta: the language spoken is Maltese

The difference is quite simple: at Maltese state schools, most subjects are taught in English, which is the official language, but some lessons are in Maltese.

The advantage is that the children quickly come into contact with Maltese people, and this is highly recommended for people who want to stay on the island for an extended period. Taking into account that children learn foreign languages incredibly quickly, the state schools should therefore also be considered.

However, you shouldn’t have any reserve regarding contact with the Catholic Church, since many state schools are still under the umbrella of the church. You must also understand that Malta is a very Christian country.

One crux regarding Maltese education: in many conversations with Maltese parents, I have learned that not all Maltese find it useful that their children learn Malti. Many would prefer every subject to be taught in English. But there are also many traditionalists in Malta.

FAQ compulsory education Malta

Malta maintains a public school system. Depending on their place of residence, students attend free of charge

-

- The elementary school (Primary School): The elementary school at the age of 5 to 11 years.

- Secondary School: The secondary school from11 to 16 years.

- Sixth Form: The Sixth Form in Malta of the last two school years (Year 12 and 13) for students aged 16 to 18.

Yes, there are commercial and church sponsors for any type of school.

English and Maltese

Verdala International School’

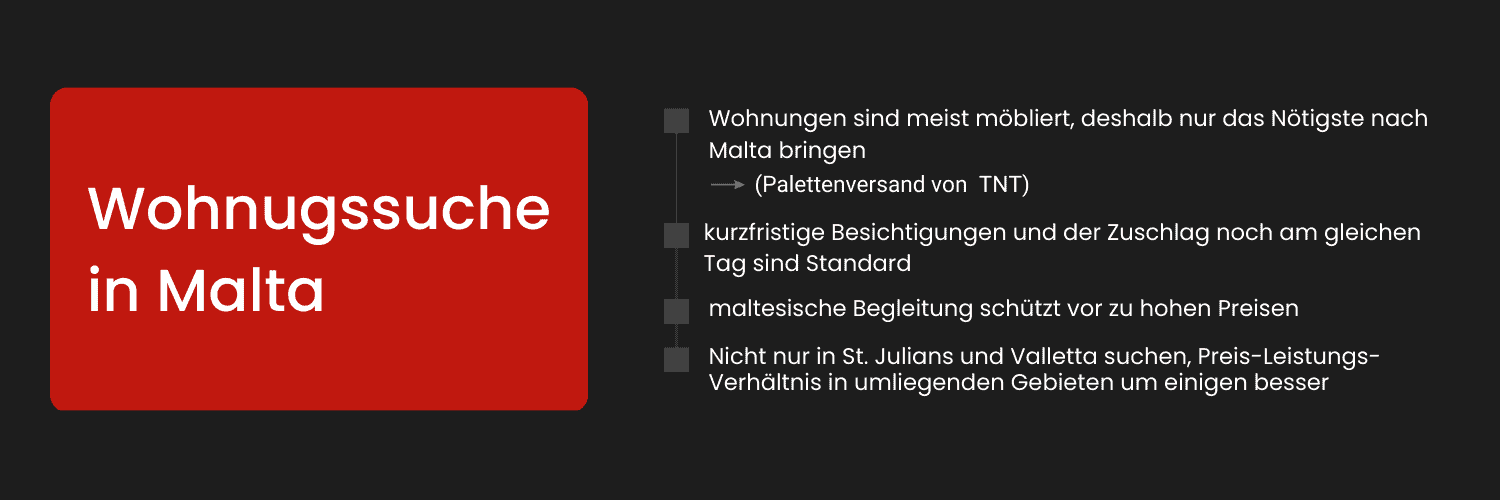

Renting an apartment in Malta – tips, tricks and costs

Every emigrant needs an apartment.

But there are a few things to keep in mind here – otherwise it can get expensive!

Please fasten your seatbelts! Here it comes:

A quick introduction to the Maltese real estate market.

You already know all about it: moving is always associated with a lot of stress.

It’s no different for anyone who has chosen Malta as their next place of residence. The Maltese housing market has its peculiarities, however, and that’s where you need to pay attention.

Moving to Malta with all your goods and chattels is not recommended.

Most rental apartments that you will find on the real estate market are furnished. Actually, I find that great. It saves you the long, expensive transport of furniture, and you can practically start your life in Malta overnight.

Whether you burden the capacity of the cargo holds of the airline that flies you to Malta is up to you.

My personal insider tip: use TNT’s international pallet shipping service to transport your most important possessions to Malta. For a Euro pallet 80cm x 120cm x 180cm, and up to 500kg, you pay about EUR 600 (compare with other sites). The shipment takes about 5 days.

Not cheap, but certainly cheaper and above all more favourable in terms of time than road transport.

Generally, searching for an apartment in Malta is a bit different, compared to Germany. In Germany, we know that if you don’t have a new place to stay two months before the end of your old lease, you’re going to start getting very nervous.

It’s quite different in Malta. Here, apartments often only come onto the market once the previous tenant has already moved out. Viewing is then necessary at short notice, and it’s not uncommon for the deal to be finalised on the same day as the viewing. And: Since the previous tenant has already moved out, you can move in immediately.

Let’s move on to an insider’s tip if you’re looking for an apartment:

Always take a Maltese with you when viewing an apartment – that increases your chances of not being ripped off (although this has improved in recent years).

It often helps if you also ask a Maltese to make the appointment for you, and ask about the price at the same time.

It doesn’t necessarily have to be an estate agent either:

if you place an ad in the Maltese newspapers, you have a good chance of getting offers for housing. The following applies:

describe what you are looking for as precisely as possible, and go in at least EUR 100 under your price limit.

Last but not least: Don’t just look in St. Julians, Sliema and Valletta.

These cities are the best known and most vibrant on the island, but in my opinion, the price/performance ratio is a bit off. If you’re looking for something outside the city limits – and “outside” doesn’t have to be more than 2-3 kilometres from the hotspots – you’ll get very good value for your money. The areas of Santa Venera, Msida and Birkara have become popular. Here, you can get an apartment with two bedrooms and a living room for about EUR 900-1,000 incl. ancillary costs (Status: January 2020).

Update December 2020: Real estate prices have fallen sharply

Triggered by the Corona crisis, real estate prices in Malta – both purchase prices and rents – have plummeted – by about 25% on average.

It is very noticeable that Maltese residents are currently moving house significantly less.

The result: significantly lower rent. A great apartment with a sea view in Sliema, that previously cost at least EUR 2,000 a month, is now available for EUR 1,500 a month. This development can also be observed in other areas. In Santa Venera/Hamrun, new two-bedroom apartments are now available for as little as EUR 600 a month.

Update 2023: Covid is over and booming again

The real estate market in Malta has recovered and the trend is pointing upwards again. Prices do skyrocket as in a classic bubble, but please don’t get the wrong idea that Malta offers particularly cheap rents. Especially in the good areas, but also for good properties in “bad” areas, you simply pay a perceived high price.

Please do not misunderstand: Malta is not Dubai or London or Monaco. That means housing is affordable. But not as favorably as is often still assumed.

My very personal advice:

I moved to Malta with very specific ideas back then, as you probably did too.

“If I’m going to move to an island, please make it front row, sea front, penthouse.”

I had it and I don’t have it anymore. My ideas and my demands have changed over the years. Have adapted Malta.

Because I moved 7 times in 5 years until I found what I liked best in Malta and because of Malta

Therefore, think a little less German and take advantage of the fact that in Malta you rent furnished. Test apartments and areas. Sometimes for 6 months, sometimes for a year.

FAQ Living and renting in Malta

The best place to live in Malta, in my opinion, is St Julians or Sliema. Both of the areas are by the sea and there are several supermarkets and restaurants within walking distance.

A “normal” 2-3 room apartment in a good area and on a good standard costs between 1200 and 1500 EUR on month. There is no limit to the top.

No. The standard is not bad, but for the relatively expensive rents you will still have to sacrifice quality.

Yes. As a rule, with the rental you get a complete equipment incl. Tableware

What is the best way to find an apartment for rent in Malta?

It’s best to go through a broker, then you have some protection against rip-offs. The broker receives half a month’s rent brokerage.

Live a carefree life in Malta – with proper planning.

Exit Taxation! How not to become a tax evader

You would like to emigrate to Malta right away?

That’s the right attitude! Nevertheless, you should pay attention to certain things, because…

…there are tax traps when emigrating, especially for the self-employed.

The keywords are exit taxation and disjunction

Let’s discuss the matter.

In my experience, one of the biggest fears of many expats is to inadvertently become a tax evader.

And indeed:

especially if you are self-employed, the German tax authorities, in particular, will put some obstacles in your path.

The reason: if you leave the country as a self-employed person, the German state loses the opportunity to benefit from your income; after all, in most cases the tax liability expires when you are no longer working in Germany.

In this context, a distinction is usually made between two types of tax: one is exit tax and the other is disjunction tax.

Exit taxation: this is an enormous tax burden for shareholders of corporations (limited liability companies, etc.)

The German state knows that it benefits in one case in particular: if you are successful and sell your company at some point. In such a case, i.e. if you are a shareholder of a corporation such as a GmbH, you would then have to pay capital gains tax on the proceeds of your income, as part of the partial income procedure.

And the moment you move abroad, the German state goes empty-handed, because

in most cases, capital gains are taxable on a private level, wherever the centre of life is situated. Do you believe that if you live in Germany, you pay capital gains tax in Germany, and if you live somewhere else, you pay it somewhere else?

Think again!

If you leave Germany, you have to pay taxes on the sale of a company, although the sale has not even taken place yet. This is referred to as a “notional capital gain”. No kidding: they “pretend” that you have sold your business at its current value, and you have to pay the full taxes on this fictitious sale.

Wham, that’s a hard blow.

But how do you calculate the value of a company that you don’t want to sell, or perhaps wouldn’t even be able to sell?

The tax authorities even have an answer to that: they apply the so-called capitalized earnings value method. They take the average profit over the last three years and multiply it by 13.5. 60% of this amount is then taxable. And that can be very expensive indeed!

Mind you, you have to pay this tax as a private person.

In the past, the exit tax could be deferred or postponed indefinitely. That’s no longer possible today!

That means the tax is due immediately!

Talk of proposals to split the payment of the tax over seven years are currently circulating. In my experience, however, that doesn’t work in practice.

Perhaps you can read between the lines – I consider this new regulation, which has been in force since 1 January 2022, to be unjust. The new regulation effectively creates a barrier to leaving the country, which is completely in conflict with the principle of freedom of establishment in the EU and, in my opinion, it therefore also violates EU law. What’s more, the fictitious sum that is applied is often completely unrealistic.

My guess: sooner or later, the ECJ will overturn the German regulation.

Is exit tax expensive? Yes. Are you hopelessy subjected to it? No.

There are ways to avoid the exit tax and, especially, to save taxes on income generated in the future. However, the ways to apply here would go beyond this scope – I will probably enter a separate post on this in the near future, if the topic is of interest. Just let me know.

In all cases, the best strategy is to move abroad early on, preferably BEFORE you become self-employed.

Disentanglement – existing business still taxable in Germany

If you have effectively avoided exit taxation, another type of tax comes into play, namely disjunction tax.

The tax authorities are not only displeased by the loss of income from the sale of a company. No, they are, of course, annoyed by the fact that your current income is no longer taxable in Germany.

So what do they do: the so-called hidden reserves are disclosed. What does that mean? All the income that your self-employment could have yielded in the near future (i.e. through existing customers, commissions, etc.) is fully taxed in your country.

So, even if you move the actual activities abroad, you must also expect to pay taxes in your country.

The consultants at DW&P would not be any good if we didn’t have a solution to this problem. I will also address this topic in another post.

Your centre of life as the biggest target area

Should you be confronted with the accusation of a tax offence after the move, in the vast majority of cases it will be because the domestic tax office assumes that you still reside in Germany.

As a rule, the tax offices don’t come up with such accusations for no reason – usually, there are at least some grounds for reasonable suspicion.

Maybe you have visited Germany quite often in the previous six months, or perhaps you are still renting an apartment in Germany, or maybe there is a car driving around in Germany, that is still registered in your name. The list of possible reasons is long and now it is your turn to prove that there is a specific reason behind all the suspicions and that your real center of life is in Malta.

Has your mother been living in your apartment since you emigrated, but the contracts are still in your name?

Draw up a contract with your mother.

Are you often in your home country on business?

Provide evidence that you are in Malta more often, and that your visits do not generate a significant part of your income.

Basically, especially in the first year after you emigrate, everything must be meticulously recorded in writing, so that, if the worst comes to the worst, any doubts on the part of the tax office can be dispelled immediately.

Finally, a few words of reassurance: Those who have fully moved to Malta will usually have no problems whatsoever in proving that they have done so. Mobile phone or electricity bills, or even a bank statement from your Maltese account are common and acceptable means of proof. There are many ways to prove that you really live in Malta.

By the way: this point is especially important if you are a shareholder of a Malta Limited company. In the case of companies, the tax authorities look even harder. Again, I like to point out my post about the 10 commandments when choosing a residence.

FAQ exit taxation

Withdrawal tax is the tax on the value of a notional capital gain of all your holdings above 1% that you hold at the time of withdrawal.

At least 25%

Yes. However, there is the possibility to spread this over several years.

Yes, I strongly advise that. The issue is complex and can be expensive if something is done wrong.’

The cost of living in Malta – is Malta expensive?

“How expensive is it to live in Malta?”

I’m often asked this question.

“Well, it depends on certain factors!”

I often give this answer, and I am usually rewarded with looks of dissatisfaction.

So, let’s put our cards on the table:

This is what it costs to live in Malta!

Different countries – different customs….

…and different prices!

You will know what it’s like from your holidays: some foodstuffs are much more expensive than they are at home, while others are cheaper, and wherever you go, advertising can be very enticing.

The same is true in Malta.

While housing and utility costs are now at about the same level as in Germany, food tends to be somewhat more expensive. This is mainly due to the fact that many of the products have to be imported.

And if a product is manufactured in Malta, it is not uncommon for there to be only one manufacturer, who can thus choose a price almost at will.

Of course, it also depends on where you buy the items.

Supermarkets in Malta: As expensive as in Germany

There are many “mini” supermarkets like Till-Late or Spar that have a manageable assortment, but are usually a bit more expensive. But they are great for quickly buying a liter of milk.

There are also several larger supermarkets: Pavi or Pama, for example. In terms of price, we are also on about the same level as a Rewe in Germany, but still cheaper than the mini supermarkets. However, these are not comparable with German supermarkets (for example Real), but rather with the prices in Rewe or Edeka.

However, the keyword globalisation also applies in Malta. The Lidl discount chain has been present on the island for a while now, and it has also been well received. The prices here are similar to those in Germany. There are many branches spread all over Malta. Always a nice change: The Bavarian Weeks, where you can get “Swabian Ravioli” (Maultauschen), as well as Schupfnudeln and Co.

Finally, you will encounter many small vegetable and fruit stands. Here, unfortunately, as is more often the case in Malta, prices are set higher for tourists. But if you regularly go to the same retailer, you won’t get cheaper prices for fresh fruits and vegetables anywhere.

And for those who like luxury and organic: Greens Supermarkets. These promise a great shopping experience, but the prices are really steep and clearly aimed at higher earners. The large markets advertise particularly good quality and good selection. This is also true. Only just: Expensive.

However, there is one thing that is cheaper here than in other countries: services that involve the use of personnel. This includes, hairdressers, nail studios or massages.

Restaurant prices in Malta

As far as restaurants go, it’s similar to Italy.

The espresso in the pastizzeria next door is available for one euro, and you can also get the cappuccino to go for little money. Here, the location is decisive for the prices. Sliema is more expensive from experience, although you can get cheap and tasty cafe in small passtizerrias here too.

Restaurant prices are similar to Germany, and of course, there are more expensive and cheaper options to choose from. No surprises, there. It’s clear that restaurants in prime locations with elaborate décor are more expensive simply because of the ambiance. This is where it really comes down to preference.

Clear recommendation, however: Check out Google Reviews. Very sweeping tip, I know, but due to the many tourists, a good perspective has arisen here that is not so much distorted.

Update 2023

Restaurants have once again become more expensive. Ok. But I have been traveling a lot lately and I must honestly say: the quality of restaurants in Malta has increased extremely.

But also the versatility. Rarely have I traveled to a country where there were so many different but also good restaurants in a small space.

And now comes an advantage of Covid. During the pandemic, many restaurants in Malta made a virtue out of necessity and took their offer to the streets, on the scooters of the couriers Bolt and Wolt.

Food delivery Malta – Breathtakingly fast

I know of no country in the world where Bolt and Wolt deliver faster than in Malta. For me, the absolute number one in terms of speed: McDonalds. If the FastFood craving should grab you times.

Do the test and order McDonalds for delivery.

Often in UNDER 10 minutes the cell phone buzzes “The courier has arrived”. Really impressive, really good, really unique.

Mobile phone and internet costs in Malta

Internet and mobile phones:

in this regard, you have to be prepared to pay a little more if you want the same quality as in Germany. Although the networks are very well developed in Malta, different rates haven’t been available for very long.

While billing by data volume is common practice in Germany, the Maltese providers (Go, Melita and Epic) are now going to offer unlimited data, at least locally, even with good downstream. However, the prices in Malta are rather higher than in Germany for a comparable package.

Everyone must decide for themselves what the speed is worth to them.

The same applies to internet at home. Fiber is now available in metropolitan areas, enabling Internet speeds of up to 2000 Mbit/s. In this respect, Malta is in no way inferior to the major German cities.

What I was able to test sufficiently, however, is 5G availability, and it is simply everywhere.

Sure, Malta is small. But even in the remotest corners I always have 5 full bars of 5G.

What is still a bit slow, however, is the supply of the latest terminals.

Rental and real estate prices for living in Malta

I broached this subject in the previous chapter.

In terms of prices, Malta has now reached the same level as Germany. The reasons:

The demand has risen sharply in recent years, as more and more people are moving to Malta from abroad.

But I don’t think it applies anywhere more than on an island that location makes the price. Those who live first row directly by the sea pay a good 50% more than those who live two streets further back. The same is true for the very popular areas like Sliema and St. Julians, which are significantly more expensive than, for example, Gzira or Naxxar.

By the way, most apartments in Malta are furnished! This should be fairly included when comparing rents in Germany and Malta. Even though I’ve never been a fan of furnished apartments myself (and probably won’t be anymore), it has one distinct advantage:

Very many people who are new to Malta often move in the first few years. You just need some time to find the right location, the right apartment, etc. With furnished apartments, this is much easier.

If you want to know more about the real estate market in Malta, you can read the guest article of Mark Molnar. Here I think it is well summarized how high the real estate prices are and where it is good to live.

My personal opinion for the future: Do not expect prices to fall sharply, rather steadily rising rents. I lived in London for a long time and space is limited there too, just like in Malta.

And there still seems to be plenty of demand, and that will continue to be reflected in prices.

FAQ How expensive is living in Malta?

A normal 2-3 rental apartment costs between 1200 and 1500 EUR per month cold.

Relatively yes. One of the reasons for this is that real estate prices are still rising. Likewise, most food has to be imported, but this makes weekly shopping expensive for restaurants.

Feels above average but not extreme. Assume 25 EUR per person for a dinner in a normal good restaurant.

There is Lidl but Aldi is not.

There are only electricity and water costs, the garbage, for example, is collected free of charge. Assume 10%-15% of monthly rent for utilities at normal consumption.

Transport in Malta – public buses or a car?

Germans love their cars…

the Maltese don’t always love their cars, but they absolutley love driving.

Which results in busy streets.

Fun Fact Malta

The annual average speed is 6km/h. Therefore, the only logical vehicle choice is a Vespa or a bicycle. But rather think twice about the bike. Because in Malta, being a cyclist is still a rarity. And Malta is probably not the safest place in the world for the bike.

Malta also has a peculiarity when it comes to importing cars.

More details in the following chapter.

Whether on the way to work, going to the supermarket or picking up the kids:

in Germany, most people use their car.

Let’s clear up one thing when it comes to Malta. Here too! In Malta, they also do everything with their car. The country has one of the highest car densities in the world, and it’s clearly evident. During rush hour, the roads are horribly congested, and you suddenly need 20-30 minutes for a route that would normally take ten minutes.

Meanwhile, the government is fully aware of the problem – and they are introducing curious taxes.

The congested roads in Malta have led the government to doing its utmost to ensure that the many immigrants and investors who move to Malta do not bring their cars from the mainland.

You heard right!

More specifically, this is implemented by imposing import tax on used cars, which varies depending on the age and model of the vehicle. But no matter what, it’s an expensive business.

In the case of a used car, the import tax often even exceeds the value of the vehicle, making it unaffordable. So whether you buy an expensive car in Malta, that has been imported by a dealer, or import your own car and pay tax on it, is up to you….

…either way, having a car in Malta is not cheap, even though it is, without question, very convenient!

And yet, the number of cars registered in Malta continues to increase at an almost constant rate. At the end of 2019, the number exceeded 400,000 registered cars for the first time. Madness!

Udpdate 2023: There are now over 500,000 cars. The number of cabs increased by 50% (!!!!) in 2022.

The Malta Road Department builds and builds and builds.

Two examples

10 years ago, there was always that ONE point in the morning where a simple trip to the office, airport, or just through Malta would extend by sometimes an hour.

The one point: Kappara Roundabout. In the first really big traffic project that I witnessed, this traffic circle was bridged, in English / Maltese it is called: a “Flyover” was built. After 2 years of work (faster than planned), the Kappara Flyover was inaugurated and things have been going much faster for 7 years.

But:

In the meantime, there are also small traffic jams here.

Example 2 Airport flyover and tunneling

A major major project was to route traffic around the airport. This project was finished 1 month ago (as of July 2023).

And I am impressed:

You really get to your destination faster and more conveniently, especially at the airport. But with the growing car numbers, let’s see how much longer.

However, you should think twice before buying a new car. There are two reasons for this:

Narrow roads + left-hand traffic.

You do get used to driving on the left, but nonetheless, you might need a while to get used to the way the Maltese drive. Yes, every now and then, one of your side mirrors, might be ripped off by a passing car. And the narrow streets are not necessarily car-friendly either.

Nevertheless, so far everyone I know has come to terms with the Maltese way of driving.

However, one or the other will certainly look around for alternatives, and in Malta you will find them. Public transport is well developed, and buses in particular are a popular alternative to owning a car. Although the reliability of the schedules leaves something to be desired, they do offer a cheap way to get around. Especially with the Tallinja Card, a personalized transport card, bus travel becomes even easier. The card is personalized with a photo and the name of the holder. The credit can be easily topped up online, via the Tallinja app or at points of sale, and it does not expire.

From October 1, 2022, Tallinja Card holders will be able to travel free of charge on day routes, night routes and on special services. Only the Tallinja Direct (TD) routes are subject to a charge. When using these paid buses, the corresponding fare is deducted directly from the card’s balance as soon as it is validated on the reader in the bus.

It is also interesting to note that the Tallinja Card can be used not only for bus rides. It is also valid for Valletta Ferry Services, Barrakka Lift and Tallinja Bike. However, these services are not free and different fares apply depending on the service.

For those who do not yet have a Maltese ID card: The Tallinja Card is also available without it. A quick visit to www.publictransport.com.mt/en/tallinja-card and https://www.publictransport.com.mt/en/faqs-free-travel provides all the necessary information and an easy way to register.

Otherwise, the day fare for a bus ticket is €2 and the night fare is €3. Tickets can be purchased from the bus driver on all our buses.

Source: www.publictransport.com.mt/en/cash-tickets

Bolt and Uber in Malta: Driving a cab with Uber and the Uber clone

Those who like it even more comfortable can fall back on the offer of Bolt, eCabs or Uber.

They specify in the apps where they want to go and immediately see approximately how much the ride will cost. As a rule, the driver is usually there in less than three minutes.

In terms of price, they are a bit cheaper than the local cabs and you pay – depending on the distance – between 6-10 euros for a distance usual for Malta. From St. Julians to the airport, it’s about EUR 15.

Summary

- Malta has one of the highest traffic densities in the world

- Import tax is paid on new and used cars – this can be calculated online

- Public transport (buses) is cheaper with an ID card

GoTo and Bolt are good alternatives

Live a carefree life in Malta – with proper planning.

Gyms in Malta

Malta is by the sea and it is warm most of the time. Most of the time so warm that you can swim. And can be on the beach. And who doesn’t want to look fit on the beach. Or the way I would like myself to be:

Fitter.

But even if you work at your desk all day, a back workout or a Crossfit session to let off steam is certainly not harmful.

I also have clients who are influencers, streamers or celebrities, they need to keep fit for professional reasons.

Whatever the motivation:

What about Gyms in Malta?

I list a bit further down the gyms again in detail including address, price and picture.

The supply of well-equipped gyms has also improved a lot. Both small muck stalls like the Spartan Kettlebell Gym in St Julians and large-scale offerings with their own indoor running track like Fort Fitness in Tigne Point Sliema. There is something for everyone.

If you don’t like machines, but prefer functional training paired with sweaty classes, check out the F14 Crossfit Gym.

The Gym at the Hilton Hotel offers a small indoor pool and squash courts in addition to the gym. The Intercontinental Hotel houses the Cynergi Gym in its catacombs, which is also very large. The latest trend in Malta is “Elite Gyms” or similar luxury offerings. If you like it spiritual, you should visit the Lords Gym in St Julians.

But there are also countless groups, classes and personal trainers who work on the beach at sunrise, for example.

There are no discount or cheap gyms for 9.99 a month. Assume min. 60 EUR per month per month for membership from

Fort Fitness Sliema

Address: Fort Cambridge, Triq Tigne’, Sliema

Membership from 60 EUR per month

Feature: Large area, well equipped, central.

Crossfit F15

Address: 58 Triq l-Universita, L-Imsida

Membership from 89 EUR per month

Feature: Licensed Crossfit Gym, Good Organization, Professional Trainers

Spartan Kettlebells Malta

Address: WF9Q+7C3, Forrest St, St Julian’s

Membership from 75 EUR per month

Features: Alternative class offerings for mothers and pregnant women, for example, family atmosphere, international trainers and clients.

Lords Gym

Address: Park Towers, Level 1, George Borg Olivier St, St Julian’s STJ 1083.

Membership from 60 EUR per month

Features: Box training, spiritulity, good opening hours

Hilton Gym

Address: Portomaso Saint Julian’s, STJ 4012

Membership from 100 EUR per month

Features: Luxury Gym, Squash Court, Sauna, Pool

FAQ Gyms in Malta

Gyms in Malta are a bit more expensive than in Germany and there are no comparable discounters. Memberships range from 50 EUR to over 100 EUR per month

Yes, there are 2 official Crossfit Gyms and one of them is detailed in this article, F15. However, there are also quite a few “functional training” studios, which are gyms based on the same or similar principles as Crossfit.

Yes. There are several trainers who offer yoga or pilates most mornings.

Very clear and simple: In St Julians and Sliema

As a rule, no. Large hotels, however, offer pool use with membership in their in-house fitness clubs.

Malta culture

When you first come to Malta, it’s easy to get the impression that Malta is a city. Because there is no real demarcation between the many localities that you actually pass through when you cross Malta.

Sometimes it is a street that forms the border or even just a house.

But when summer comes, you will quickly notice how much different localities and even parts of localities there are.

Summer in Malta: the season of street parties.

You will suddenly see colorful flags and lights strung across streets by helpers from house to house during the day. You will see magnificent statues on pedestals that appear on one on sidewalks or traffic light islands.

And on the day of the event, market stalls line the sidewalks next to food trucks.

When night falls and the sun sets, you will be able to admire the spectacle that has been so lovingly built for 2 or 3 nights. Bustle, people, food, pastries, sweets and lots of Krims Krams. But what is really unique: the fireworks.

Welcome to the Festa or Feast.

No matter how small the town may be, when it comes to fireworks, the municipal and local boards don’t let their hair down. It is said that one locality wants to outdo the others and will organize fireworks that will put the neighbors to shame.

You’ll see so many fireworks during the summer that eventually you won’t even pay attention.

Manoel Theatre in Valletta

Take a trip back in time. Everything in Malta is smaller and tighter than you know it from Germany. This rule also applies to classical opera houses or theaters. When I booked my first ticket for a performance at the Manoel Theater, I found photos on the Internet of a magnificent opera house, like in Milan or Vienna.

To celebrate, I booked a box in the upper tiers.

How should I describe it?

To put it respectfully: Manoel Theatre fits very well with Malta’s greatness. Because it is tiny. That’s not to say you can’t comfortably attend an event there, but if you’re going to book a box, strongly suggest you book all 4 seats there. Then you have “normal” space there with accompaniment for two.

The tickets are not very expensive either. I never paid more than 10 EUR per person.

Attention Maltese instead of English!

If you book a ticket at the Manoel Theater, make sure the performance is in English, not just the title! Otherwise, it will probably be in Maltese and you won’t understand anything at all.

The hypogeum

If you want to travel back in time much further and visit something truly spectacular and moving, book a ticket to the Hypogeum in the Three Cities.

As a small digression in the prehistoric history

It is said that the indigenous population of Malta simply disappeared from the island several thousand years ago, which remains a mystery to local and international archaeologists and paleontologists. Because this people did not disappear without leaving their traces.

Temple Temple Temple:

You can find more than 15 of them in Malta. Temples older than the pyramids. From a Stone Age prehistory, but still of monumental presence and impact. I saw most of them, but I was most impressed by the Hypogeum, which you enter through a rather nondescript entrance in a residential neighborhood

Book in advance:

Because of the preservation, only small groups are allowed into these catacombs by pre-booking.

If you’re down there, you know why: it’s cramped, dark, and there’s high humidity.

What exactly the builders of this site intended with the construction is still not 100% clear. What is certain is that it is a sacred place, a place of spirituality.

There was no knowledge or experience of architecture or structural engineering at the time of construction. Therefore, the builders used the statics of the earth and rocks and cut domes and arches into the rock.

Imagine the work. And the creativity.

They stand under a stone arch that looks like it was “glued to the ceiling”. But in reality, everything was hollowed out from the inside and shaped to look like a statically correct dome.

The entrance fee is about 10 EUR and plan 90 minutes for the visit. Here is the link https://heritagemalta.mt/explore/hal-saflieni-hypogeum/

Maltese specialties

Mdina

If you have half a day, visit Mdina. The former capital Malta is located right in the middle on a hill and is completely pacified.

I recommend that you go there by cab or bus, because as everywhere, but in front of Mdina especially obvious is the parking problem. And I say intentionally BEFORE Mdina, because no cars are allowed in Mdina. But even if cars were allowed to drive here, most drivers wouldn’t dare, because the streets are alleys.

Alleys lined with house fronts of warm yellow sandstone. Alleyways of marble and cobblestones. And none of the alleys are really straight or go straight. After a few dozen meters, each of the streets in Mdina makes a slight bend to the right or left.

It is historical speed limit.

I have been told that the roads were intentionally bent or created with slight curves. This was because it prevented a destructive level of speed from being reached by horses or horse-drawn carts in the event of enemy incursion.

I recommend Mdina in the early morning.

Because then there are almost no tourists here and the experience provides one thing above all: awe. Close your eyes and imagine that you have traveled through time to the 18th century. Den Mdina is in exactly this condition. Even the streetlights are still from that time.

In Mdina, I recommend visiting the only observation deck. It is a square in front of the balustrade in the northeast direction. From here you will get a view of Malta like you won’t get anywhere else.

Also worth seeing: the museum of the cathedral. When you are in front of the big cathedral, the museum is on the right side.

Here, in addition to an impressive historical collection of the parish of Mdina, you will find a rich treasure of artifacts and jewelry even original drawings (I think copper) by Albrecht Dürer. And originals by Caravaggio.

Maltese features, in a nutshell

Malta churches

Malta is arch-Catholic. An overwhelming majority of the population, over 90%, belongs to the Roman Catholic Church. I know of one Protestant parish in Valletta, namely St. Andrews. And I know of a mosque, namely in Paola. But Catholic churches are more than days per year in Malta, in a country with less than 500,000 inhabitants.

From mini chapel to opulent cathedral:

You can really find a place of worship anywhere. In Valletta sometimes even less than 50m apart. And some churches are so discreetly placed in the middle of 2 apartment buildings, sometimes you have to look twice.

Especially beautiful:

Small chapels on cliffs, such as St Mary Magdalene Chapel on the imposing Dingli Cliffs or the Chapel of Immaculate Inception in Melieha. Or the Kappella ta’ San Pawl Nawfragu near the Peters Pool. I always find it reassuring to discover a beacon of spirituality in the midst of the “wilderness” and to linger there briefly.

Unfortunately, these 3 chapels are rarely open, so if you want to look inside, it’s worth doing a little research on the internet to see when services are. For this purpose, there is the following website of the Diocese of Malta https://www.quddies.com.mt/

Imposing:

The famous St Johns Cathedral in Valletta. The interior is magnificently and richly decorated, painted and adorned and you can’t help but be amazed.

The absolute highlight: Caravaggio

One of the most famous painters and one of the most famous paintings in the world unite in the “Beheading St John the Baptist” by Michelangelo Merisi da Caravaggio in the Cathedral. The technique of the master, especially his play with light impresses. Not so impressive: the entrance to the church costs an entrance fee (10 EUR) and you sometimes have to wait a long time in the heat.

Fun Fact of the churches in Malta:

Pay attention to this when you stand in front of a church in Malta. Some churches have two clocks. Of these, one goes right and the other goes backwards. According to superstition, this is to confuse the devil.

FAQ Culture and Churches in Malta

The Hypogeum, the temples on Gozo, the ancient capital Mdina and St John Cathedral in Valetta.

Malta’s culture today is strongly religious and conservative. The preservation of values but also of culture itself is a declared goal in Malta?

Probably Joseph Calleja, the world-famous opera singer and tenor.

Yes. There are more churches than days per year, so you have quite a bit to do if you want to visit them all.

Yes. One can search for any language on the quddles.com.mt website. English fairs are quite a few. In German I know only the Sunday service in St Barbara in Valletta.

My opinion about Malta

So much for the theory….

…it’s often complicated in practice.

I often experience amazing things.

Therefore: Let me leave you with some final words.

I am glad that you are interested in Malta. You have already reached an elementary stage:

Sufficient gathering of information in advance.

I often encounter people planning to emigrate, but they are in no way aware of the implications of their plan. Every country is different: there are peculiarities everywhere, there are great things everywhere, and there are not so great things everywhere.

If you dare to take the step of moving to Malta, I would be pleased if I could help you a little bit in your endeavor.

Best wishes!