Dubai – das Land mit den unbegrenzten Möglichkeiten, günstigen Steuern und neuerdings der Promi-Hotspot in der Coronapandemie.

Dank der Influencer-Auswander-Welle ist Dubai gerade mehr denn je im Fokus der gewollten Auswanderer. Influencer wie die Harrisons, Fiona Erdmann, Sami Slimani oder Georgina Fleur leben auf Dubai und zeigen Dubai von der schönsten Seite und locken damit immer mehr Auswanderer und Touristen.

Dubai – die Stadt, die aktuell in aller Munde ist.

Auswandern nach Dubai: die ultimative luxuriöse Wüstenmetropole mit sommerlichen Temperaturen das ganze Jahr über, mit einer 0-%-Steuerregelung? Der Traum der Reichen und Schönen?

Diesen Eindruck gewinnt man zumindest aktuell von Dubai. Doch kann Dubai wirklich alles halten, was es scheinbar verspricht? Gibt es wirklich nur Vorzüge oder hat die Stadt auch einen Haken?

Lassen Sie uns gemeinsam diesen Fragen nachgehen und in das Leben & die Kultur Dubais eintauchen.

Grundsätzliches zu Dubai

Bevor wir starten, werde ich Ihnen in diesem Kapitel grundsätzliche Infos zu Dubai geben.

Die geographische Lage Dubais

Die Vereinigten Arabischen Emirate und damit auch Dubai liegen außerhalb der EU und gehören dem Kontinent Asien an. Die VAE grenzen an Saudi-Arabien und den Oman und liegen südlich unterhalb des Irans, getrennt von dem Persischen Golf.

Dubai ein Emirat der Vereinigte Arabischen Emirate (VAE)

Dubai ist eine – die größte – Stadt der Vereinigte Arabischen Emirate (VAE) oder UAE (engl. United Arab Emirates) und die Hauptstadt des Emirats Dubai.

Die Vereinigte Arabischen Emirate (VAE)

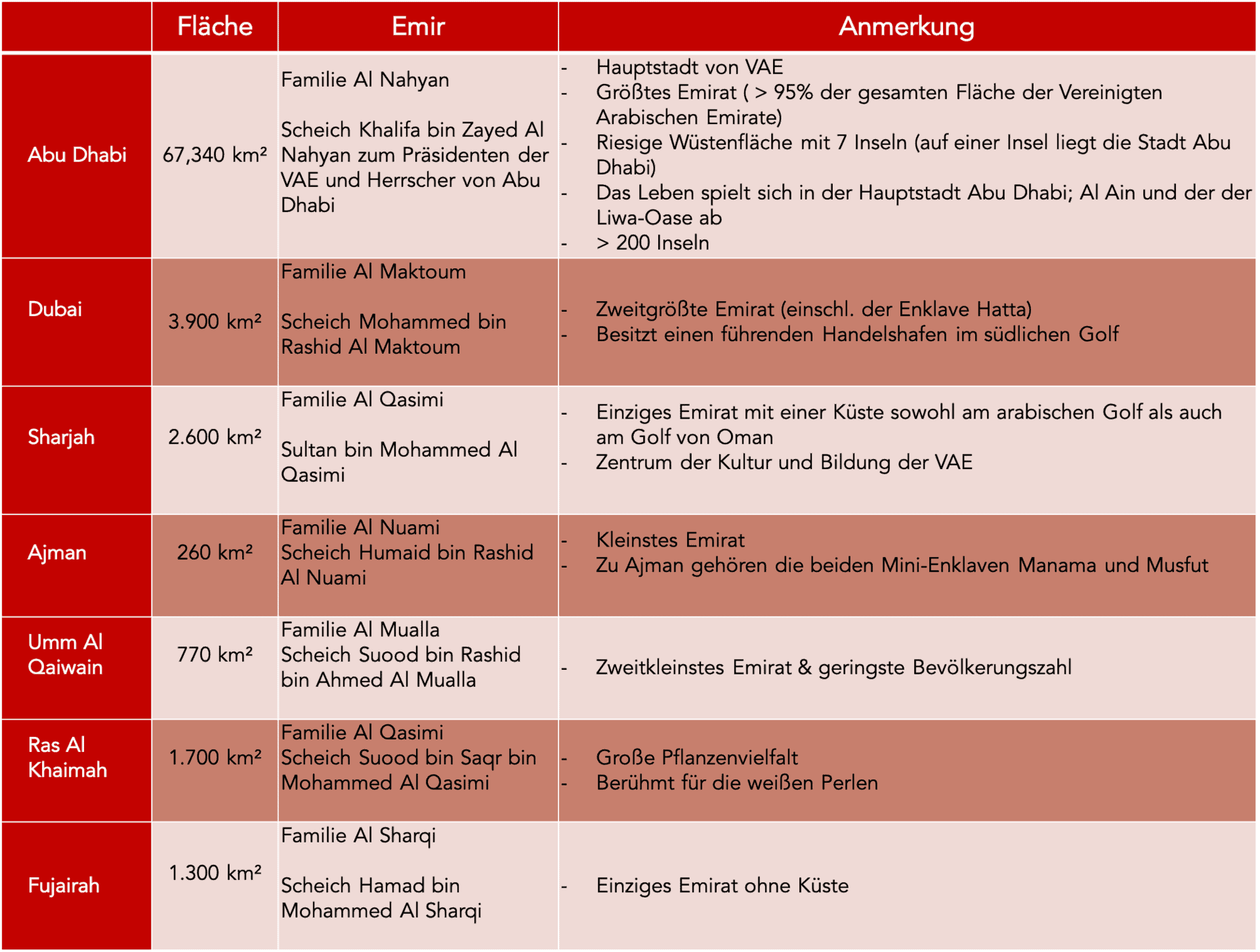

Die Vereinigten Arabischen Emirate (VAE) am Persischen Golf haben insgesamt sieben Emirate. Emirat wird der Herrschaftsbereich eines Emirs bezeichnet und ist historisch gesehen eine durch einen Fürsten verwaltete Provinz. Mittlerweile existieren auch Emirate, die als Staaten gelten.

Ein Emir wiederum bedeutet übersetzt „Herrscher“ oder „Fürst““ oder „Gouverneur“. Mit dem Begriff war ursprünglich der Befehlshaber eine muslimischen Soldatengruppe gemeint, der nach Eroberungen den Platz des Gouverneurs einnahm und nach Anerkennung durch den Kalifen strebte. Ein Kalif galt früher als Herrscher des gesamten islamischen Reichs, weswegen die Herrschaft auch als Kalif bezeichnet wurde. Mittlerweile ist ein Kalif ein Herrscher von einem unabhängigen islamischen Teilstaat. Der Emir hingegen ist ein Befehlshaber oder Fürst, dessen Herrschaftsgebiet Emirat genannt wird.

Die Hauptstadt der Vereinigten Arabischen Emirate Abu Dhabi.

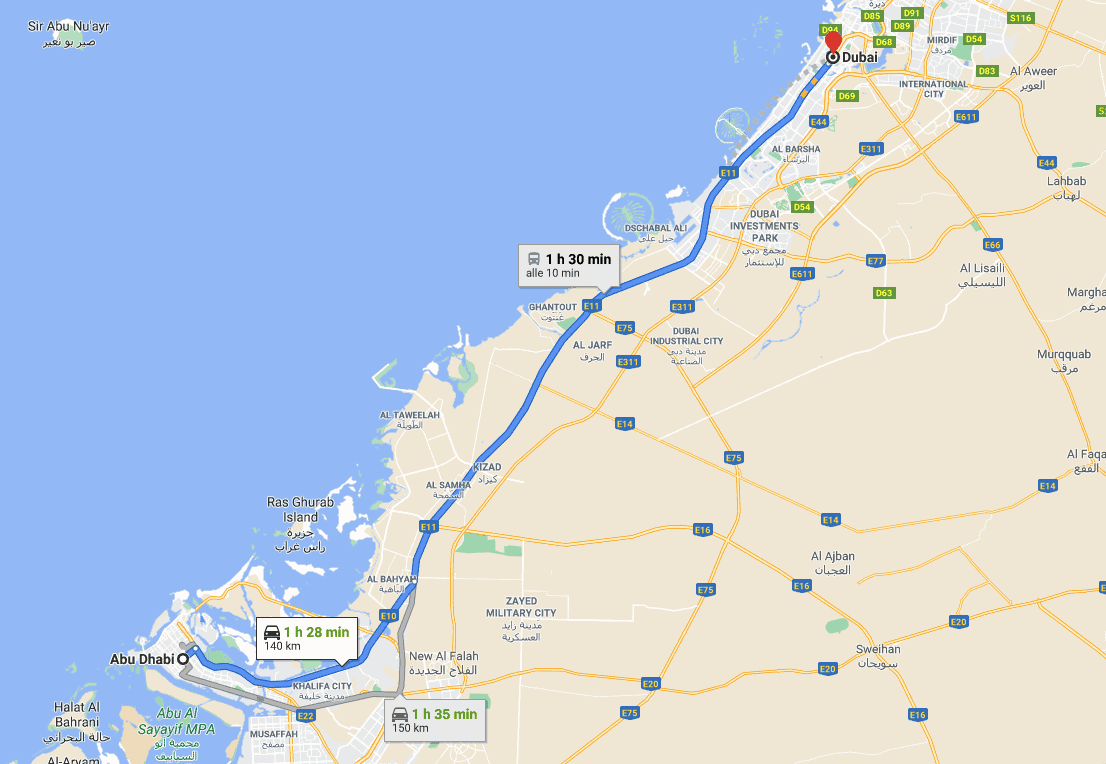

Dubai liegt ca. 140 km von Abu Dhabi entfernt und kann durch eine Bahn, die alle 20 Minuten fährt, in 1,5 Stunden erreicht werden.

Die sieben Emirate der VAE

Die sieben Emirate der Vereinigten Arabischen Emirate sind

- Abu Dhabi (Hauptstadt)

- Dubai

- Sharjah

- Ajman

- Umm Al Qaiwain

- Ras Al Khaimah

- Fujairah

Eine kleine Übersicht über die 7 Emirate der VAE

Jetzt bin ich etwas abgeschweift. Ich finde es jedoch wichtig ein wenig Wissen über die Historie Dubais zu haben. Ab jetzt widmen wir uns wieder Dubai.

Wollen Sie steuerlich fehlerfrei nach Dubai auswandern?

Fluganbindung Deutschland – Dubai

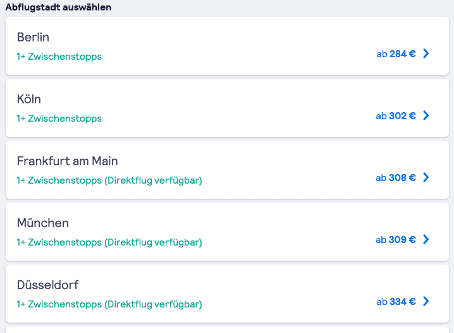

Täglich fliegen aus Deutschland mehrere Flugzeuge nach Dubai. Zwar beträgt die reine Flugzeit von Dubai nach Deutschland 6 h 15 min, häufig ist die Flugzeit aufgrund des Mangels an Direktverbindungen höher. Ehrlicherweise muss ich aber hier anmerken, dass dieser Zustand auch an Corona liegen könnte.

Wie auch immer, wenn Sie frühzeitig buchen, finden Sie bereits Flüge ab 280 Euro. In meinem Beispiel habe ich heute (01.03) für Anfang November, also ein gutes halbes Jahr im Voraus, geschaut.

Screenshot (von Deutschland nach Dubai)

Ausländerquote in Dubai

Dubai florierte in den letzten Jahren. Nicht zuletzt wegen der Steuervorteile wanderten immer mehr Ausländer in das Land aus, sodass die Ausländerquote mittlerweile bei fast 90% liegt. 60% von der Gesamtbevölkerung stammen aus Südasien.

Insgesamt leben in Dubai über 3 Millionen Menschen. Über 90% der Bevölkerung des Emirats Dubai leben in der gleichnamigen Stadt Dubai.

Laut auswandern-info.com sind in der Zeit von 2008 bis 2017 offiziell 15.026 Deutsche in die VAE ausgewandert, wovon 11.576 wieder nach Deutschland zurückkehrten. Das heißt mit anderen Worten, dass knapp 77% der Auswanderer Dubai innerhalb von 10 Jahren den Rücken zugekehrt hat. Warum? Lesen Sie dazu bitte weiter.

Wirtschaft

Dubai gilt als eine sehr reiche Region. Durch den Erdölreichtum und eine liberale Wirtschaftspolitik konnte das Emirat außerordentliches Wachstum verzeichnen. Mittlerweile macht der Verkauf von Erdöl nur noch rund 50% aus. Dubai ist außerdem ein Gold- und Diamantenumschlagplatz.

Dubai ist vor allem aufgrund seiner spektakulären Bauprojekte, die fast alle privat finanziert wurden, bekannt.

Als eine Art Wahrzeichen schmückt der Burj Khalifa seit 2010 die Stadt. Der Wolkenkratzer gilt mit einer Höhe von 828 m als mit Abstand höchstes Gebäude der Welt. Der Wolkenkratzer ist der Mittelpunkt des Stadtzentrums Downtown in Dubai und darin befindet sich das weltweit größte Einkaufszentrum. Insgesamt besitzt Dubai über 200 Wolkenkratzer mit mehr als 150 m Höhe, 20 davon sogar mit über 300 m Höhe.

Darüber hinaus verfügt Dubai über einen führenden Handelshafen im südlichen Golf.

Dubai hat zwar bis 2008 ein enormes Wirtschaftswachstum verzeichnen können, doch seit der Finanzkrise änderte sich diese Entwicklung: Der Bauboom verlangsamte sich und auch das Wissen über die Endlichkeit des Ölvorkommens führte zur Anspannung. Seither konzentriert sich Dubai auf den Tourismus.

Freizeit

Neben den zig Bauprojekten finden sich viele Vergnügungsparks, die für Freizeitspaß sorgen. Auch sehenswert sind die Wasserspiele der Dubai Mall Fountain Show mit 6.000 Lichtern oder eine Fahrt mit dem „Abra“-Wassertaxi auf dem Burj Lake. Dünen-& Kamelsafari gehören natürlich auch auf die To-Do-Freizeitliste Dubais.

Luxus auf Dubai

Dubai zählt also nicht ohne Grund zu einer der meistbesuchten Städte der Welt und verfügt über die höchsten Tourismuseinnahmen weltweit.

Dubai lockt jedoch nicht nur Touristen, sondern auch Reiche aus aller Welt. Ja, Dubai ist reich und luxuriös. Dubai ist sogar ein richtiges Luxusparadies, das keine Wünsche offen lässt. Dabei lockt Dubai mit moderner Architektur, luxuriösen Hotels, riesigen Shopping Malls und pompösen Springbrunnen.

Dubai – eine Stadt der Superlative. Auf Dubai scheint alles möglich.

Das Leben in Dubai

Wenn Sie Dubai als Unternehmens- und Firmenstandort in Erwägung ziehen, dann sollten Sie sich auch über Faktoren wie das Klima, die Amtssprache, die Religion und die Kultur Gedanken machen.

Wie hoch die Lebenshaltungskosten im Vergleich zu Deutschland sind, schneide ich ebenfalls kurz an.

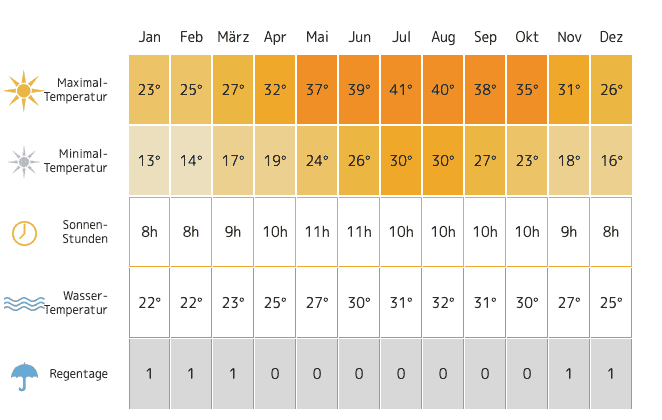

Das Klima in Dubai

Die arabische Halbinsel Dubai hat ein arides, subtropisches Klima, also ein Wüstenklima. Das heißt, es ist extrem heiß und trocken. Wie Sie in der untenstehenden Klimatabelle sehen können liegt die durchschnittliche Höchsttemperatur bei 40° C und nachts liegt die durchschnittliche Tiefsttemperatur bei 30° C. Die Temperatur des Wassers des Persischen Golfs liegt zwischen warmen 22 °und 32° Grad.

Doch wann genau ist die beste Reisezeit in Dubai?

Die beste Zeit, Dubai als Tourist zu besuchen ist im „Winter“. Auch wenn man in Dubai nicht von einem richtigen Winter sprechen kann, denn für uns Europäer sind auch die „winterlichen Dubai-Temperaturen“ auf einem sommerlichen Niveau.

Für uns angenehme Temperaturen herrschen also von November bis April, dies ist auch die touristische Hauptsaison.

Im Sommer hingegen ist es wiederum derart heiß, dass Sie schnell wieder in eine klimatisierte Mall entfliehen wollen. Natürlich ist das auch von Mensch zu Mensch unterschiedlich.

Quelle: https://www.reise-klima.de/klima/dubai

Die Amtssprache in Dubai

Die offizielle Amtssprache des Emirates und der Stadt ist Arabisch. Dennoch ist man in Dubai nicht aufgeschmissen: Viele Bewohner beherrschen Englisch, sodass man sich mit der Weltsprache gut verständigen kann. Auch darf nicht vergessen werden, dass Dubai einen hohen Ausländeranteil verzeichnet, dessen gemeinsamer Nenner die Sprache Englisch ist. Dennoch sollte man bereit sein, arabisch zu lernen und sich mit der islamischen Kultur auseinanderzusetzen.

Die Religion in Dubai

Dubai ist ein muslimisch geprägtes Land. Zwar wohnen hier auch Christen und Hinduisten sowie Buddhisten, sind mit 25% Gesamtanteil jedoch in der Minderheit. Das Emirat Dubai ist das einzige, dass ein Hindu-Tempel und eine Sikh-Gurudwara besitzt.

Kultur in Dubai

Wer sich für die islamische Kultur interessiert, ist in Dubai richtig. Alte Tradition trifft Moderne. Sie werden Museen finden, in denen Sie die Wurzeln der Kultur finden können.

Natürlich müssen Sie sich auch in Dubai, wie in jedem anderen Land, an die Kultur des Landes anpassen. Das heißt im konkreten Fall, dass man bspw. bei der Besichtigung von Moscheen auf kurze Kleidungsstücke verzichten sollte.

Ein weiterer wichtiger Aspekt ist der Ramadan. In der Zeit des Ramadans (meistens von Mitte April bis Mitte Mai) gelten andere Regeln: in der Öffentlichkeit darf nicht gegessen oder getrunken werden. Auch Kaugummi kaufen ist untersagt.

Währung in Dubai

In Dubai, wie auch in den anderen Emiraten, gilt der Dirham (Abkürzung: AED, Dh, Dhs sowie DM) als offizielle Währung. 1000 Euro sind 4.028,48 AED.

Rechtsprechung und Regeln auf Dubai

Ja, die Rechtsprechung. Ein schwieriges Thema in Dubai, weswegen ich kommentarlos die wichtigsten geltenden Gesetze und Regeln aufführen werde.

Die Rechtsprechung in Dubai basiert auf der Scharia. Die Scharia beschreibt „die Gesamtheit aller religiösen und rechtlichen Normen, Mechanismen zur Normfindung und Interpretationsvorschriften des Islam“. (Quelle).

Konkret bedeutet das beispielsweise, dass der Austausch von Zärtlichkeiten und Küssen in Dubai mit Gefängnis-, Geldstrafen oder Deportation bestraft werden kann. Ebenso ist außerehelicher Sex strafbar.

Sofern Sie mit Ihrem Partner nicht verheiratet sind, ist ein Zusammenleben mit Ihrem Partner auch strafbar.

Außerdem gelten auch strengere Regeln in der U-Bahn: Dort ist Essen und Trinken ebenso wie Kaugummi kauen verboten.

Fluchen in der Öffentlichkeit und die Mitnahme von Alkohol gelten ebenso als ein strafbares Vergehen.

Sicherheit in Dubai

Auch wenn eine gewisse Skepsis gegenüber muslimisch geprägten Ländern vorherrscht, so kann man dennoch ganz beruhigt durch die Straßen gehen, ohne Angst haben zu müssen.

Lebenshaltungskosten (inkl. Wohnung) auf Dubai

Natürlich ist es immer schwer eine pauschale Aussage über die Lebenshaltungskosten treffen zu können, denn je nach persönlichem Lebensstil schwanken die Lebenshaltungskosten. Nichtdestotrotz habe ich ein bisschen recherchiert und bin auf folgende Informationen gestoßen:

Eine 2-Zimmer-Wohnung kosten zwischen 100.000 und 140.000 AED, also 22.615 bzw. 31.661 Euro pro Jahr, bzw. 1.884 bzw. 2.638 Euro pro Monat. Dazu kommen nochmal Nebenkosten in Höhe von 1.200 bis 5.000 AED, also 271 bzw. 1.130 Euro pro Monat.

Die Kosten für eine Schule liegen je nachdem zwischen 20.000 und 40.000 AED.

Laut auswandern-info benötigt man ca. 3.993,42 Euro (17.793,51 AED) um einen Lebensstandard wie in Deutschland mit 3.700 Euro aufrecht zu halten (Quelle).

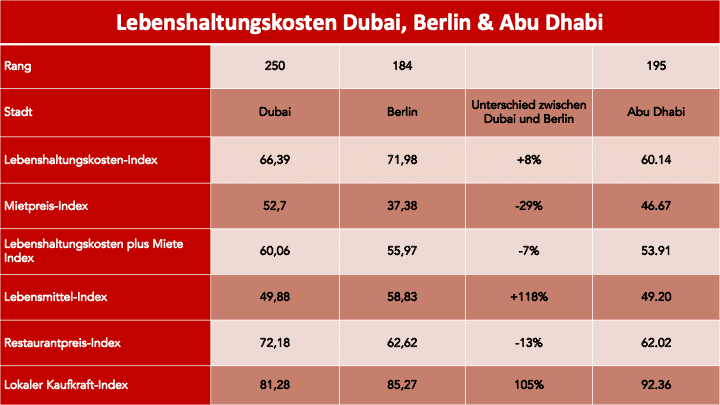

Zwar sind die Verbraucherpreise 8,53% niedriger als in Berlin, durch die hohen Mieten sind die gesamten Verbraucherpreise jedoch knapp 8% höher als in Deutschland.

Auch die Restaurantpreise sind höher als in Deutschland.

Interessant ist auch, dass Elektrogeräte günstiger als in Deutschland sind, da die Einfuhrzölle niedrig sind. Auch Autos sind aufgrund der geringen Einfuhrzölle sehr preiswert. Nicht nur der Kauf, auch der Unterhalt eines Autos ist in Dubai preiswert – die Benzinpreise sind vergleichsweise niedrig.

Die untere Tabelle zeigt Ihnen verschiedene Indices: den Lebenshaltungskosten-Index von Dubai und Berlin sowie Abu Dhabi.

Eigene Darstellung, in Anlehnung an: https://www.numbeo.com/cost-of-living/rankings_current.jsp

Die Einreise nach Dubai

Was müssen Sie bei der Einreise nach Dubai beachten gibt es sonstige Dinge, die Sie beachten müssen? Wie läuft die Wohnungssuche ab? Ein kleiner Überblick.

Die Einreise nach Dubai

Um nach Dubai einzureisen benötigen Sie zwar einen Reisepass, aber kein Visum, denn das wird bei der Einreise automatisch erteilt. Genauere Einreisebestimmungen finden Sie hier: https://www.auswaertiges-amt.de/de/aussenpolitik

Touristenvisum

Es gibt ein Touristenvisum, dass bei der Einreise erteilt wird und für 90 Tage gilt und einmal um 30 Tage verlängert werden kann.

Während Corona nach Dubai reisen

Touristen können auch aktuell mit einer Auslandkrankenversicherung und einem negativen Covid-19-PCR-Test, der nicht älter als 96 Stunden ist, nach Dubai einreisen. Das Ergebnis muss in englischer und arabischer Sprache ausgedruckt sein.

Aufenthaltsgenehmigung in Dubai: Residence Visa

Um in Dubai leben zu können, benötigen Sie das sogenannte Residence Visa also eine Aufenthaltsgenehmigung. Es gibt drei Wege, wie sie an eine Aufenthaltsgenehmigung kommen können.

- Angestellter (Residence Visa)

- Immobilie kaufen (mindestwert > 1 Mio.) + Nachweis von Einkommen Investors Visa)

- Gründung/ Beteiligung einer Firma (Investors Visa)

Bei einer Firmengründung auf Dubai kommen auf Sie ca. 4 Tausend Euro Gründungsgebühren zu sowie weitere 4 Tausend Euro jährliche Kosten.

Arbeitsvisum in Dubai

In Dubai kann man für 200 AED jährlich ein Arbeitsvisum beantragen. Voraussetzung dafür ist eine Einladung einer Firma. Arbeitnehmer mit einer Festanstellung erhalten eine Aufenthalts- und Arbeitserlaubnis.

Laut auswanderlust.de muss man darüber hinaus sein Schul- bzw. Studienabschlusszeugnis bei der Botschaft der VAE legalisieren lassen sowie sich einer amtsärztlichen Untersuchung unterziehen. Zusätzlich muss ein Nachweis über die Krankenversicherung erbracht werden.

Eine solche Aufenthaltsgenehmigung gilt in der Regel für 3 Jahre und ist verlängerbar. Eine unbegrenzte Aufenthaltsgenehmigung ist in VAE fast unmöglich und nur durch bspw. einen einflussreichen Arbeitgeber machbar. Personen ab 60 Jahren erhalten zudem keine Arbeitserlaubnis mehr.

Arbeiten auf Dubai

Der hohe Anteil an Ausländern lässt es schon vermuten: Der Arbeitsmarkt in Dubai hat einiges zu bieten. Zwar heißt es offiziell, dass Arbeitnehmer der VAE bevorzugt werden, dennoch stehen Ihre Chancen gut auf dem Arbeitsmarkt. Insbesondere Fachkräfte und Akademiker wie Ärzte, Krankenpfleger, Apotheker, Ingenieure, IT-Spezialisten und Manager haben hohe Chancen.

Eine Arbeitswoche in Dubai beträgt 5 Tage bzw. 48 Stunden. Die Mittagspause ist meistens zwischen 14 und 17 Uhr. Freitag und Samstag sind das offizielle Wochenende in Dubai.

Insgesamt sind die Gehälter niedriger in AED als in Deutschland und das, obwohl Arbeitnehmer in Dubai nur 5 % Sozialabgaben haben – unabhängig davon, wieviel Geld verdient wird.

Auswandern nach Dubai – das müssen Sie wissen

Da Deutschland und VAE kein Sozialversichungsabkommen haben und Dubai bzw. die Vereinigten Arabischen Emirate keine gesetzliche Rentenversicherung haben, muss sich fortan privat versorgt werden. Da es kein gesetzliches Versicherungs-System in VAE gibt (Ausnahme: Emirat Abu Dhabi,) sollten Auswanderer eine Auslandskrankenversicherung abschließen.

In Dubai wohnen

Zunächst gilt zu beachten, dass Sie – wie bereits oben erwähnt – mit einem Partner nur dann zusammenwohnen dürfen, sofern Sie verheiratet sind.

Hinsichtlich der Wohnungssuche gibt es auch einen großen Unterschied zu Deutschland: Der Unterschied bezieht sich auf den Zeitpunkt der Wohnungssuche. Denn in Dubai ist die Wohnungssuche vor allem eins: kurzfristig. Es ist eher unüblich Monate im Voraus eine Wohnung zu mieten. Auf Dubai sehen Sie sich mehrere Wohnungen an und entscheiden sich meist unmittelbar danach, ob Sie in die Wohnung einziehen möchten oder nicht.

Steuern auf Dubai

In diesem Kapitel erhalten Sie einen Überblick über alle Steuervorteile Dubais.

Der Grund, warum Dubai Auswanderungsziel vieler reicher Unternehmer und Privatpersonen ist, liegt (höchstwahrscheinlich) auch an dem lukrativen Steuermodell bzw. der vorherrschenden Steuerfreiheit auf Dubai. UPDATE: seit Juni 2023 wird Dubai 9% Steuern erheben – mehr dazu in Kapitel 5.

In Dubai wird keine Einkommensteuer erhoben – jegliche Arten des Einkommens wie Gehalt, Rente oder Kapitaleinkommen sind also steuerfrei. Auch gibt es in Dubai keine Vermögenssteuer. Ebenso muss keine Steuer auf Immobilienbesitz gezahlt werden und es werden auch keine Grundstückgewinnsteuern erhoben. Lediglich eine Übertragungsgebühr von 4% muss entrichtet werden. Erbschaft und Schenkungssteuern müssen auch nicht entrichtet werden. Lange Zeit gab es darüber hinaus keine Mehrwertsteuer – seit 2018 wird eine Mehrwertsteuer von 5% erhoben.

Anmerkungen: Die 0%-Steuerregelung gilt ab Juni 2023 nicht mehr – mehr dazu in Kapitel 5.

Wollen Sie steuerlich fehlerfrei nach Dubai auswandern?

Die Haken bei Dubai

Dubai die Stadt, die mit Luxus, niedrigen Preisen und Steuerfreiheit lockt.

So scheint es zumindest auf den ersten Blick. Doch wie es so schön heißt: nicht alles ist Gold was glänzt.

Lassen Sie uns also gemeinsam die Nachteile Dubais beleuchten.

Steuerfreiheit immer und überall?

Jein, das stimmt so nicht ganz.

Wenn Sie sich den Artikel durchgelesen haben, mögen Sie vielleicht jetzt denken: Mensch super, das ist ja ein Paradies. Ich gründe kurz eine Firma in Dubai und muss meine Einkünfte nicht mehr versteuern. Dann habe ich richtig viel Geld auf dem Konto, dass ich dann zuhause in Deutschland ausgeben kann und wie der König in Frankreich leben kann.

Tja, dann muss ich Sie leider an dieser Stelle enttäuschen. So einfach ist das nicht.

Update vom April 2023

Die Vereinigten Arabischen Emirate führen erstmals Steuern für Unternehmen ein. Das Gesetz soll ab Juni 2023 gelten. Diese Nachricht trifft wohl viele Unternehmer hart, denn Dubai ist nicht zuletzt aufgrund der 0%-Steuer so attraktiv für ebensolche.

Diese Nachricht stellt eine bedeutende Veränderung für alle Unternehmer und Selbstständige, die in Dubai wohnen oder nach Dubai vorhaben auszuwandern, dar. Doch auch Privatpersonen sollten sich nicht in Sicherheit wiegen.

Meinen persönlichen Kommentar zum Thema finden Sie hier.

Warum? Hier erstmal dir Schlüsselpunkte der neuen Bestimmung.

Ab Juni 2023 müssen Unternehmer, die in Dubai ihr Unternehmen angemeldet haben, ab einem Einkommen größer als 375.000 VAE-Dirhams (102.000 USD bzw. 90.007 EUR) den gesetzlichen Steuersatz von 9% zahlen.

Die Vereinigte Arabische Emirate werden zum ersten Mal eine föderale Körperschaftssteuer auf Unternehmensgewinne einführen, wie das Finanzministerium bekannt gab. Die Körperschaftssteuer wird von den „bereinigten buchhalterischen Nettogewinn“ des Unternehmens erhoben.

Laut Aussage des Ministeriums werden Privatpersonen nicht mit ihren Einkünften aus Beschäftigung, Immobilien, Kapitalbeteiligungen oder anderen persönlichen Einkünften besteuert, die nicht mit einem Gewerbe oder Unternehmen in den VAE in Verbindung stehen. Die Steuer wird aktuell auch noch nicht auf ausländische Investoren angewandt, die keine Geschäfte im Lande tätigen.

Das mag für Sie jetzt vielleicht erstmal beruhigend klingen. Doch wer sagt, dass Dubai nicht in den kommenden Jahren auch hier eine Steuer für Privatpersonen einführt? Aus meiner +20-jährigen Erfahrung habe ich eins gelernt: Staaten planen Jahre im Voraus und führen immer Schrittweise neue Veränderungen ein und lassen uns immer nur einen Teil wissen. Bis wir die Nachrichten „verdaut“ haben und sie dann mit neuen Gesetzen um die Ecke kommen. Allein die Aussage von dem Staatsminister für Außenhandel Dr. Thani Al Zeyoudi „Das Thema (Einkommenssteuer) steht derzeit überhaupt nicht zur Debatte“ lässt mich darauf schließen, dass es nur eine Frage der Zeit ist, bis auch Privatpersonen in Dubai besteuert werden. Quelle

Das Ende für die Start-Up Zeit

Der Schwellenwert für die Besteuerung von etwa 90 Tausend Euro Gewinn pro Jahr ist doch recht niedrig und wirkt sich gerade für kleinere Unternehmen mit hohen Kosten für die Gründung und Fortführung des Unternehmens negativ aus. Gerade als aufsteigendes Unternehmen mit Wachstumsambitionen ist es wichtig sich in einem Umfeld anzusiedeln, wo erstens Planungssicherheit herrscht und zweitens eine unternehmerfreundliche Steuer herrscht.

Es macht also durchaus Sinn als Klein- und Mittelständisches Unternehmen die langfristige Niederlassung in Dubai in Frage zu stellen. Auch unter dem Aspekt, dass Unternehmen in den Freizonen auch indirekt besteuert werden.

Wie sollten nun Unternehmer bzw. Unternehmen vorgehen?

Nunja, ich empfehle eine Evaluation Ihrer aktuellen Situation.

- Was bringt Ihnen der Standort Dubai langfristig?

- Welche Nachteile entstehen durch den Standort Dubai?

- Ist eine Planungssicherheit garantiert?

- Wieviel Kosten entstehen Ihnen?

- Welche Alternativen existieren?

Die genannten Punkte sind natürlich höchst individuell und sollten mit Ihrem internationalen Steuerberater geklärt werden. Vorsichtig bitte auch hier vor dem Interessenkonflikt, je nachdem wo Ihr Steuerberater ansässig ist!

Nichtdestotrotz nehme ich an dieser Stelle noch kurz Bezug zu dem letzten Punkt. Denn eine mögliche Alternative ist ganz klar Malta.

Die Alternative von Dubai: Malta

Nicht nur weil Malta innerhalb in der EU liegt und als Amtssprache Englisch hat. Malta hat einen effektiven Steuersatz von 5% und bleibt auch so bestehen. Der Prime Minister Robert Abela hat erst kürzlich in seiner Rede für den Wahlkampf (dieses Jahr sind in Malta Wahlen) ganz klar kommuniziert: an Maltas lukrativer Steuerpolitik wird sich nichts ändern. In Malta gilt also:

- 5%ige Effektivitätssteuer auf den Gewinn juristischer Personen durch die 6/7-Regel

- Bei Lizenzgebühren und Zinssätzen beträgt die Rückerstattung oft 5/7, sodass der endgültige Steuersatz hier bei 10% liegt

Zudem können in Malta ansässige Personen von einem umfangreichen Netz von Doppelbesteuerungsabkommen profitieren, die sie davor schützen, dass dasselbe Einkommen in verschiedenen Ländern mehrfach besteuert wird. Falls kein DBA besteht, verfügt Malta über ein Entlastungssystem.

Wenn Sie gerne für sich in einem Gespräch die Alternative Malta unverbindlich evaluieren wollen, lade ich Sie herzlich ein einen Rückruf über das untenstehende Kontaktformular anzufordern:

Mehr Infos zu Malta finden Sie hier:

Leben in Malta – Die wichtigsten Infos zum Auswandern (2024)

Wie geht man vor, wenn man nach Malta auswandern möchte? Was muss man beachten? Welche Fehler vermeiden? All das kläre ich in meinem umfassenden Beitrag zum Thema Auswandern nach Malta.

Firma in Malta gründen – Alle Infos zur Malta Limited Gründung in 2024

Eine Malta Limited zu gründen, verspricht niedrige Steuern in einer florierenden Umgebung. Ich möchte ungeschönt erklären: Für wen macht die Firma in Malta Sinn, was sagt das Finanzamt und wie gestaltet man die Lösung richtig.

Dubai, außerhalb der EU

Sie kehren der EU den Rücken zu. Das heißt auch, dass Sie den Vorteilen der EU den Rücken zukehren. Wahrscheinlich haben Sie es bereits vergessen, doch in der EU zu leben bringt einige Vorteile mit sich: Angefangen bei der einheitlichen Währung, über den sozialen Bereich wie der Sozialversicherungssysteme oder der medizinischen Grundversorgung in einem Gastland der EU hin zu dem freien Binnenmarkt, der freien Handel über Landesgrenzen hinweg ermöglicht. Die Vorteile der EU auf der eine Seite, sind entsprechende Nachteile außerhalb der EU auf der anderen Seite.

Die Entfernung zu Deutschland

Darüber hinaus natürlich die kurze Entfernung zum Heimatland: Deutschland. In Dubai leben Sie sehr weit weg von Ihrer Familie. Dessen sollten Sie sich bewusst sein. Mal eben kurz nach Deutschland fliegen wird nicht so einfach möglich sein.

Sozialversicherungsabkommen

Innerhalb der EU bleiben auch Rentenansprüche erhalten. Durch ein Sozialversicherungsabkommen bleiben sogar Rentenansprüche zwischen der EU und Amerika erhalten. Ein solches Sozialversicherungsabkommen zwischen Dubai und Deutschland existiert nicht.

Zudem ist ein Auswandern ohnehin mit viel Bürokratie verbunden. Ein Umzug außerhalb der EU ist darüber hinaus mit zusätzlichen Hürden wie die Beantragung des Visums verbunden, das gerne mal 6 Monate dauert. Auch ein Umzug nach Dubai von Deutschland aus, ist nicht ohne weiteres möglich und mit einem extremen Aufwand verbunden, sodass meistens die Lösung „alles verkaufen“ gewählt wird.

Außerdem muss man sich bewusst sein, dass nach einer gewissen Zeit bestimmte Ansprüche verfallen können wie bspw. die Ansprüche auf einen Erwerbsminderungsschutz oder Arbeitslosengeld I.

Vielleicht auch ein interessanter Punkt: Laut wmn müssen Internetberühmtheiten, die nach Dubai auswandern, einen Vertrag unterschreiben, der besagt, dass sie in keiner Form schlecht über Dubai sprechen dürfen (Quelle: https://www.wmn.de/buzz/diese-influencer-sind-bereits-in-dubai-id57991). Vielleicht betrifft Sie das zwar nicht direkt, dennoch wollte ich Ihnen diesen Punkt nicht vorenthalten.

Wollen Sie steuerlich fehlerfrei nach Dubai auswandern?

Fazit

Ich hoffe, dass Sie anhand meiner Informationen ein guten Überblick über Dubai erhalten haben und sich selbst Ihre Meinung bilden können. Dennoch möchte ich Ihnen meine persönliche Meinung in diesem Abschnitt mitteilen.

Wie Sie lesen konnten, gibt es zwar eine Reihe von Vorzügen in Dubai, aber ebenso gibt es auch eine Reihe an Nachteilen, die Sie nicht vergessen dürfen.

Für mich persönlich wäre Dubai als Unternehmens- und Wohnstandort keine Option, da ich mich in der europäischen Kultur sehr wohl und sicher fühle. Die arabische Kultur mag zwar auch ihre Vorzüge haben, aber durch die strengen Regularien würde ich mich mit meiner Familie nicht wohl fühlen. Auch wenn Malta im Sommer sehr warm wird, so glaube ich dennoch, dass Dubai um einiges heißer ist.

Daher würde ich Ihnen von Unternehmer zu Unternehmer raten, sich neben Dubai auch andere Alternativen wie zum Beispiel Malta anzuschauen.

Malta ist innerhalb der EU, hat eine kurze Entfernung zu Deutschland und ist trotz eines Effektivitätssteuersatzes von 5% auf keiner schwarzen oder grauen Liste gelistet. Außerdem hat Malta ein sehr gutes Mittelmeerklima. Da die Amtssprache Englisch ist, ist der bürokratische Aufwand geringer als in manch anderen sogenannten Steueroasen, bei denen Sie teilweise Übersetzer engagieren müssen.

Wenn Sie mehr über Malta kennenlernen möchten, empfehle ich Ihnen diesen Artikel zum Umzug nach Malta.